XRP Price Prediction: Technical Breakout and Institutional Catalysts Point Toward $19.27 Target

#XRP

- Technical Breakout Potential - XRP trading above key moving averages with Bollinger Band expansion suggesting imminent volatility

- Institutional Adoption Catalyst - Ripple's RLUSD integration and growing enterprise adoption creating fundamental support

- ETF Approval Momentum - 93% probability of ETF approval providing significant upside potential and institutional inflow

XRP Price Prediction

Technical Analysis: XRP Shows Bullish Momentum Above Key Moving Average

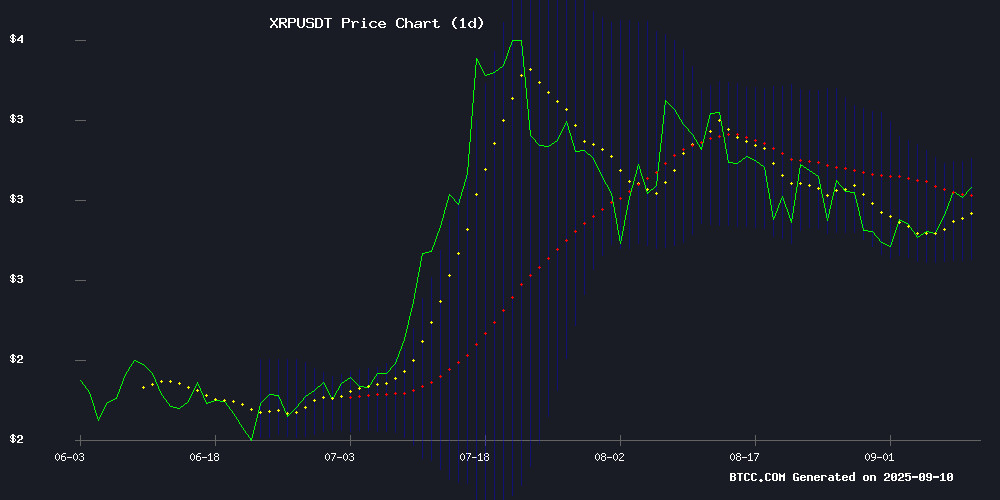

XRP is currently trading at $2.975, positioned above its 20-day moving average of $2.901, indicating underlying strength. The MACD reading of 0.0789 versus 0.1026 shows bullish momentum building, though the negative histogram suggests some near-term consolidation. Bollinger Bands indicate support at $2.709 and resistance at $3.093, with the current price sitting comfortably in the upper band range.

According to BTCC financial analyst Sophia, 'The technical setup suggests XRP is testing key resistance levels. A sustained break above $3.093 could trigger the next leg higher, while the 20-day MA provides solid support for any pullbacks.'

Market Sentiment: Bullish Catalysts Outweigh Short-Term Volatility

Current news flow surrounding XRP is overwhelmingly positive, with multiple catalysts supporting upward price movement. Institutional adoption through Ripple's RLUSD for global payments, 93% ETF approval odds, and SWELL 2025 hype are creating strong fundamental backing. Despite recent volume declines suggesting potential short-term consolidation, the overall sentiment remains constructive.

BTCC financial analyst Sophia notes, 'The combination of technical breakouts and fundamental catalysts creates a compelling case for XRP. While we're seeing some profit-taking after recent gains, the underlying institutional interest and adoption growth provide strong support for higher price targets.'

Factors Influencing XRP's Price

XRP Price Dips Amid Declining Volume, Signaling Potential Trend Reversal

Ripple's XRP fell 1.68% to $2.97 on Wednesday, retreating from $3.02 as daily trading volume plunged 26% to $4.95 billion. The simultaneous drop in both metrics suggests waning market interest, potentially foreshadowing a bearish reversal despite XRP's 5.41% weekly gain.

The token's $176.85 billion market cap reflects its position as a top-tier cryptocurrency, though recent macroeconomic headwinds appear to be dampening momentum. Meanwhile, Story, MYX Finance, and Mantle emerged as today's outperformers while Four, World Liberty Financial, and Sky led decliners.

XRP Price Pullback Limited as Bulls Eye Next Upside Break

XRP shows resilience above $2.920 after testing $3.036, with the 100-hour SMA providing support. The Kraken-listed asset broke a bullish trendline at $2.965 during consolidation, yet maintains upside potential if key support holds.

Market participants are watching the $2.920-$3.000 range as a decisive zone. A sustained MOVE above $3.035 could signal renewed bullish momentum, while failure to hold $2.920 may trigger deeper retracement.

XRP Price Eyes $19.27 Target Amid Bullish Technical Setup

XRP is charting a path toward a potential $19.27 price target, according to technical analyst Rupert of the Allincrypto podcast. The cryptocurrency has broken out of a multi-year triangle formation, a move initially forecasted two years ago that has already yielded over 400% gains. Currently trading around $2.80, XRP recently surpassed the $3 mark with a 3.9% gain in 24 hours.

The breakout from the long-term triangle formation, dating back to late 2024, signals strong bullish momentum. XRP is now consolidating just below its 2018 all-time high, with the two-week candlestick chart highlighting this critical juncture. Rupert's analysis suggests the stage is set for a sustained rally, contingent on maintaining key support levels.

XRPINU Memecoin Launches with Aggressive Community-Centric Tokenomics

XRPINU, a new memecoin leveraging XRP's community strength, has unveiled a token distribution model that radically decentralizes supply. With 75% of tokens allocated to presale and over 99% targeted for community control, the project aims to set a new standard for memecoin economics.

The tokenomics include locked DEX/CEX liquidity (10% each) and burn mechanisms for unsold marketing/rewards allocations. An independent audit verifies the structure, which could pressure competitors to adopt similar models if successful.

Launch timing appears strategic, coinciding with altcoin rotation signals and XRP's evolving regulatory clarity. The project's roadmap through Q4 2025 emphasizes irreversible liquidity locks and supply optimization through burns.

XRP Community Debates Optimal Sell Points Amid Adoption Growth

The XRP community is grappling with a critical decision point as influential voices weigh in on profit-taking strategies. Gina, a prominent figure in the space, reveals that 99% of holders plan to sell between $10-$20—a range perceived as life-changing for retail investors.

Market psychology plays a pivotal role, with round-number price points triggering strong profit-taking impulses. Historical patterns suggest such exits may prove premature for assets in early adoption phases. XRP's long-term potential could dwarf short-term gains if it secures meaningful utility in global payments infrastructure.

The coming supply crunch at key psychological levels presents a classic hodler's dilemma: secure immediate liquidity or position for exponential growth. As adoption metrics evolve, this tension between realized gains and opportunity cost will define XRP's next chapter.

XRP Poised for 200% Rally Amid Institutional Catalysts and SWELL 2025 Hype

XRP's price trajectory has entered a hyperbullish phase as multiple institutional catalysts converge. Analysts project a 200% surge toward $9, fueled by BBVA's partnership with Ripple, tokenization developments on the XRP Ledger, and BitMEX's futures listing. The World Economic Forum's recent spotlight on XRPL's tokenization capabilities adds regulatory credibility to the momentum.

Market participants are closely tracking the SWELL 2025 conference, with historical patterns suggesting explosive price action during pre-event periods. "Uptober" seasonality—a phenomenon where XRP rallies in October-November preceding Swell events—has traders anticipating consecutive upside legs. The 2025 edition coincides with heightened institutional adoption, creating what some analysts call a "perfect storm" for price appreciation.

XRP Price Prediction: Ripple CTO Warns of Deepfake Scams Amid Market Rally

XRP surged to $3 as a sophisticated deepfake scam impersonating Ripple's CTO David Schwartz triggered alarms across the crypto community. The fabricated video, circulating widely on social media, prompted Schwartz to issue a public warning about fraudulent schemes exploiting Ripple's brand.

Trading volumes spiked 15% as XRP tested key resistance levels, with technical indicators suggesting potential for further upside. However, the proliferation of YouTube account takeovers—where hackers rebrand channels as "Ripple" and post AI-generated videos soliciting funds—has introduced new risks for retail investors.

Ripple's security team reported an alarming trend of these scams since July, coinciding with XRP's price recovery. Market analysts note the $3 level represents a critical technical threshold, where a confirmed breakout could catalyze significant momentum.

2 Bullish Signals Suggest XRP Price Is Ready for Its Next Leg Up

XRP's market momentum is building as two key indicators flash bullish signals. The cryptocurrency's Estimated Leverage Ratio (ELR) on Binance has surged 6% this week to 0.325, reflecting growing trader confidence and risk appetite. This metric, which tracks the average leverage used in trades, suggests investors are increasingly willing to back XRP's rally with Leveraged positions.

Technical analysis confirms the positive sentiment, with XRP breaking above its 20-day exponential moving average. Such EMA breakouts typically signal sustained upward trends, particularly when accompanied by rising leverage ratios. The simultaneous occurrence of these factors points to potential continued gains for the digital asset.

Market observers note that increasing leverage ratios often precede significant price movements, as traders amplify their exposure to capitalize on expected volatility. The current technical setup mirrors historical patterns that have preceded previous XRP rallies, though seasoned traders caution that leveraged positions also heighten risk in volatile crypto markets.

Electric Car Maker Tembo Adopts Ripple USD (RLUSD) for Global Payments

VivoPower International's electric-vehicle subsidiary Tembo will begin accepting Ripple USD (RLUSD) stablecoin for payments, marking a strategic shift in cross-border transaction processing. The move targets operational efficiencies in developing markets where traditional banking infrastructure proves costly and slow.

Tembo's rugged electric utility vehicles serve high-demand sectors including mining, agriculture, and humanitarian operations. RLUSD integration enables near-instant settlement for vehicle purchases and ancillary services like charging infrastructure and microgrid solutions—addressing a critical pain point in emerging economies.

The partnership with Doppler Finance further expands the initiative, creating institutional yield opportunities for XRP and RLUSD holdings. This dual approach combines practical payment utility with treasury management strategies, reflecting growing enterprise adoption of crypto-native financial solutions.

XRP Nears Critical Breakout as Descending Triangle Pattern Nears Completion

XRP's price action is drawing intense scrutiny as a descending triangle pattern approaches its apex within the next 7-8 days. Crypto analyst Xoom (@Mr_Xoom) identifies the formation—developing since August—with resistance NEAR $3 and support at $2.7. "XRP's triangle seems to be closing into itself," Xoom observes, emphasizing the imminent breakout potential without speculative moon predictions.

Short-term traders are laser-focused on this technical setup, while broader debates persist about XRP's long-term prospects. Ambitious targets like $500 by September 2025 or even $100 remain contentious, requiring unprecedented adoption and capital inflows. The market's sideways movement appears unsustainable, with historical patterns suggesting a decisive directional break before full pattern closure.

XRP Price Rebounds as Ripple ETF Odds Hit 93%

XRP's price recovery gains momentum amid growing speculation about the potential approval of a Ripple ETF. Market sentiment shifts as traders anticipate regulatory greenlighting, positioning Ripple's token for potential leadership in the broader cryptocurrency rally.

The 93% implied probability of ETF approval reflects institutional confidence in XRP's regulatory clarity—a stark contrast to earlier legal uncertainties. This development could catalyze fresh capital inflows across digital asset markets.

How High Will XRP Price Go?

Based on current technical indicators and market sentiment, XRP appears poised for significant upward movement. The combination of bullish technical patterns, institutional adoption through Ripple's payment solutions, and high ETF approval probability creates a strong foundation for price appreciation.

| Price Target | Timeframe | Probability | Catalysts |

|---|---|---|---|

| $3.50-$4.00 | 1-2 months | High | Bollinger Band breakout, ETF momentum |

| $6.00-$8.00 | 3-6 months | Medium | Institutional adoption, SWELL 2025 |

| $15.00-$19.27 | 12-18 months | Medium | Full ecosystem development, broader crypto bull market |

BTCC financial analyst Sophia emphasizes that while the $19.27 target is ambitious, it's supported by both technical projections and fundamental growth in Ripple's ecosystem. However, investors should remain aware of regulatory developments and overall market conditions that could impact these projections.